In the case of motor buses motor lorries and motor taxis used in a business of running them on hire the rate of depreciation increased from 30 percent to 45 percent.

Motor vehicle depreciation rate 2020 ato.

Motor car engine assembly and manufacturing assets.

1 jul 2011.

Car depreciation cost limit.

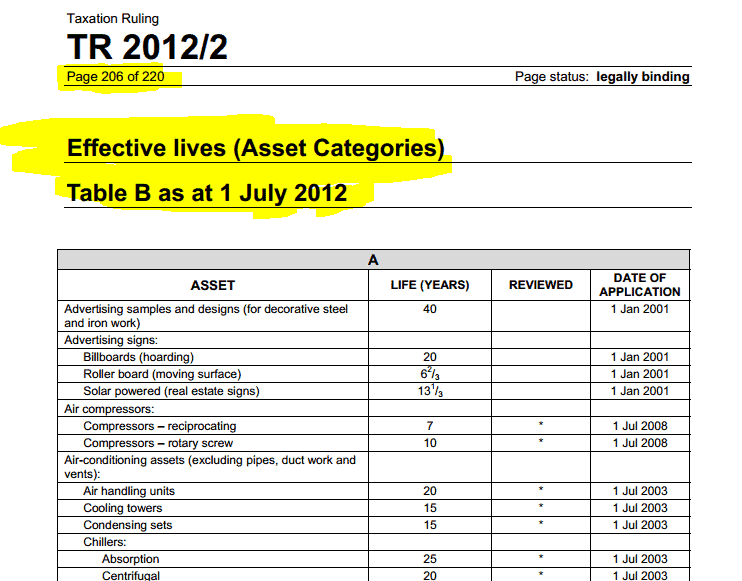

Rates are reviewed regularly.

Ato depreciation rates 2020 table a.

Motor vehicle tyre or tube retailing 39220.

Control systems including mimic panels.

If you use a capital asset such as a car or machinery in earning your income you may be able to claim a deduction for the cost of that asset spread over its effective life.

The depreciable cost of motor vehicle is subject to the luxury car limits which assumes an upper limit on the cost on which depreciation is calculated if the vehicle costs more than the limit depreciation is only calculated on the limit.

Uses a rate that takes all your vehicle running expenses including registration fuel servicing and insurance and depreciation into account.

Ancillary and support assets.

72 cents per km for 2020 21.

How you use this method.

Cement tankers incorporating tank and trailer see table b motor vehicles and trailers trailers having a gross vehicle mass greater than 4 5 tonnes.

68 cents per km for 2018 19 and 2019 20.

Bottom hole assemblies including logging while drilling tools.

Used for car and light truck repairs.

66 cents per km for 2017 18 2016 17 and 2015 16.

Used for car and light truck repairs.

Ato depreciation rates 2020 table a.