If you use your own car in performing your work related duties including a car you lease or hire you may be able to claim a deduction for car expenses.

Motor vehicle depreciation rate ato.

You must use the actual costs method to work out motor vehicle expenses regardless of the type of motor vehicle.

The depreciation of most cars according to tax office estimates of useful life is 12 5 of the vehicle cost per year.

Ato depreciation rates 2020 table a.

66 cents per km for 2017 18 2016 17 and 2015 16.

Ato go to ato gov au.

The car limit for 2020 21 is 59 136.

This information relates to car expenses only.

There s an upper limit on the cost you use to work out the depreciation for the business use of your car or station wagon including four wheel drives.

Uses a rate that takes all your vehicle running expenses including registration fuel servicing and insurance and depreciation into account.

68 cents per km for 2018 19 and 2019 20.

How you use this method.

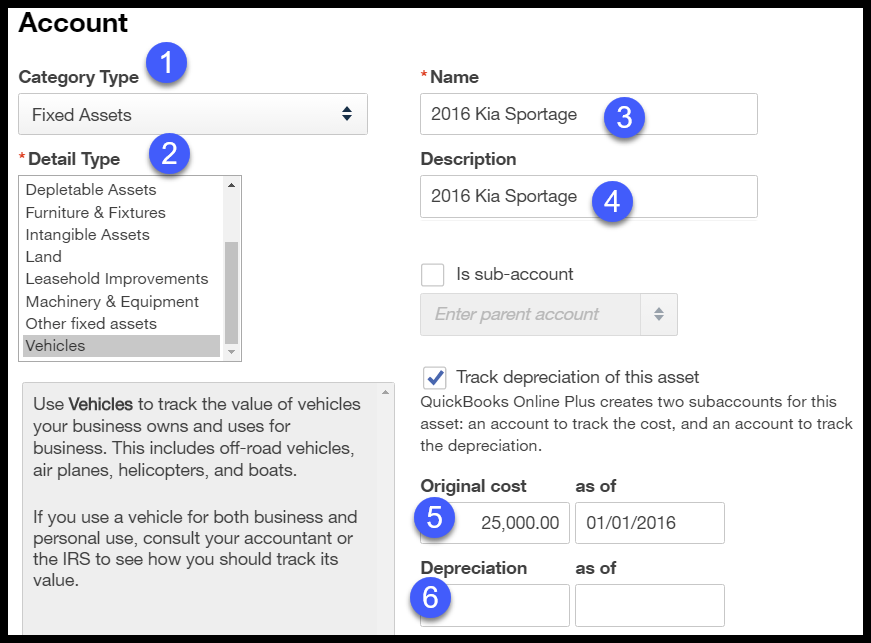

Depreciation of vehicles for tax purposes can be claimed when used to produce taxable income.

Note also that where motor vehicles are concerned luxury cars have an upper depreciation limit.

There are different calculation methods for claiming business motor vehicle expenses depending on your business structure and the type of vehicle.

Rates are reviewed regularly.

Converting effective life to the percentage depreciation rate spreadsheet calculator if you need a hand with the conversion of effective life in years to a depreciation percentage we ve built a simple spreadsheet in ms excel which does the job.

Bus vehicle body assembly assets on supplied motor and chassis see table a motor vehicle.

If the travel was partly private you can claim only the work related portion.

You use the car limit that applies to the year you first use or lease the car.

If you operate your business as a company or trust you can also claim for motor vehicles provided to an employee or their associate as part of their employment.

Interest on a motor vehicle loan.

Motor vehicle body and trailer manufacturing 23120.

72 cents per km for 2020 21.

Simplified depreciation rules including instant asset write off for small businesses with an aggregated turnover of less than 10 million from 1 july 2016.

But for commercial vehicles such as taxis and hire cars the rates are much higher 25 and 20 respectively because the estimated useful lives of those vehicles is shorter.

From 1 july 2020 the following car threshold amounts apply.

/TSLACF-----063329aec6ea4dabb3170b1e65b8246d.jpg)